Is 2025 the Time to Buy?

While it's impossible to predict the future, data suggests that home prices (especially in the Bay Area) will continue to rise, even if/when mortgage rates fall. A lower mortgage rate won't necessarily mean lower monthly payments if home prices increase, and planning ahead is key.

If you're preparing to invest in real estate this year, consider the information below and consult with a trusted real estate agent for guidance.

Individuals who hold equity in real estate have a higher net worth compared to non homeowners. Investing in a "starter" home today could yield the down payment on your dream home later on.

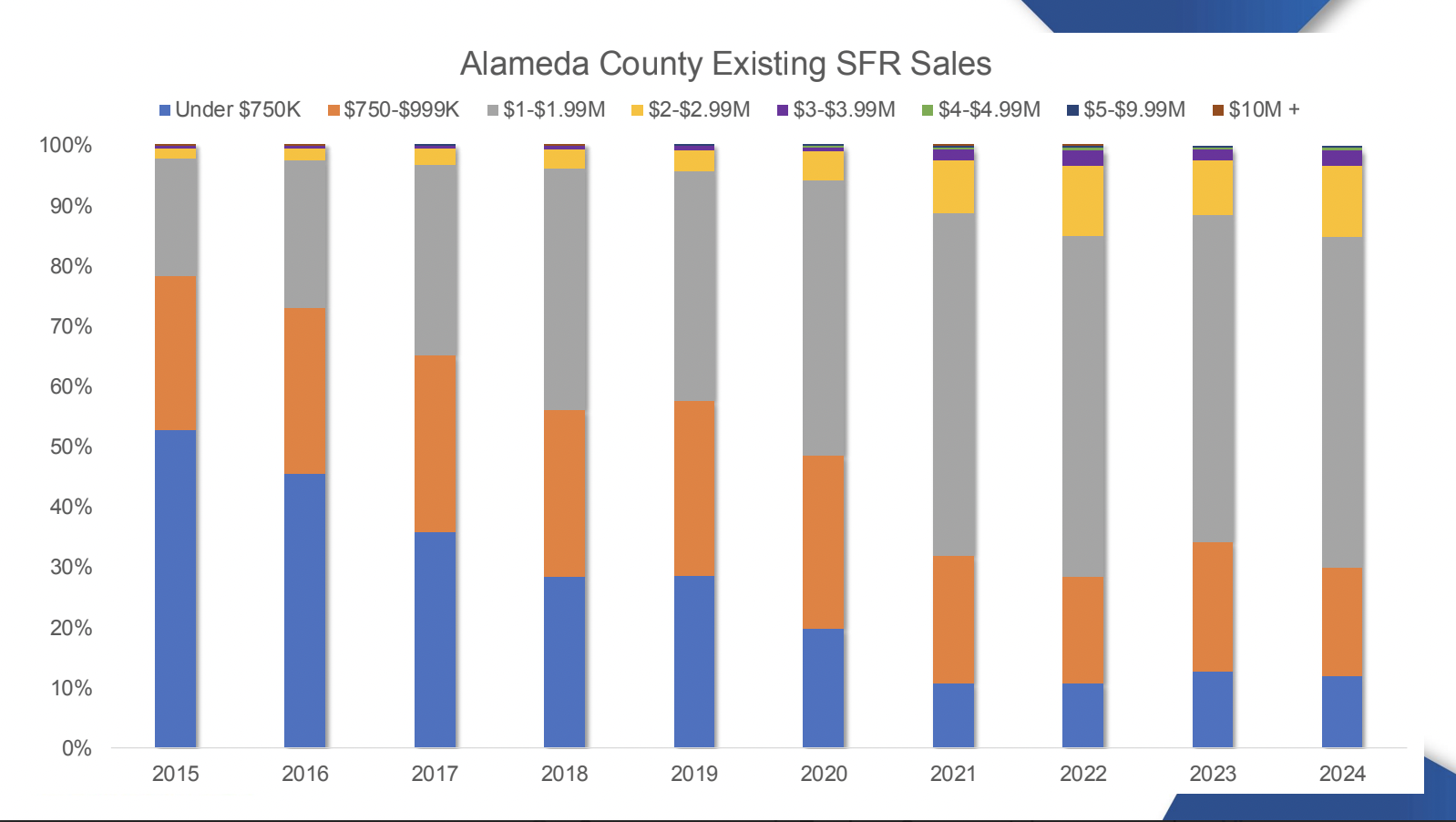

In 2024, Single Family Homes in the $1-1.99M range increased in Alameda County. As this area continues to be a desirable and competitive market, homes below the $1M mark are becoming less and less.

Experts predict lower interest rates by the end of 2025, however this number is volatile and changing on a daily basis.

If home ownership is in your future, plan ahead by meeting with a lender, getting pre-approved to understand your purchasing power, and preparing for when the time to buy is right for you.

For help connecting with a trusted lender, please reach out.

*All data provided by CAR